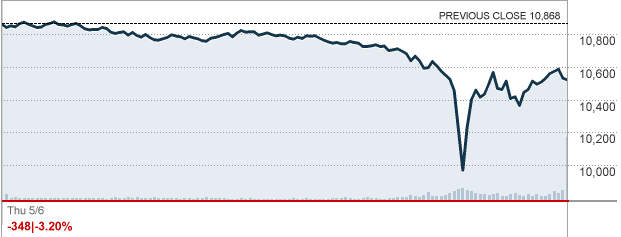

A wild day on the markets

The Dow Jones Industrial Average fell nearly 1,000 points today, the largest intra-day fall since 1987.

It’s not quite certain yet what caused it, with some blaming an “erroneous trade”, possibly via human error or a computer glitch. It seems the initial fall, whatever the cause, then triggered many more sells as paranoia over the global situation, particularly Greece, grew. Crazy!

http://www.bloomberg.com/apps/news?pid=20601087&sid=a3tiFiVZLZwg&pos=1

Read my lips – this is not another credit crisis.

Europe is in trouble, but anyone who didn’t know that hasn’t been paying attention all year. The rest of the world will grow fine – this was part of the reason global economies were expected to grow sluggishly out of the recession.

Southern Europe is in big trouble for sure. But this is not like late 2008, hell it ain’t even as concerning as mid-2007.

http://www.cnbc.com/id/36999483/

Confusing million for billion it seems …

Bahahahahahahahahahahaha!

Of course, we were assured that 2008 wouldn’t be 2008 either… until it was…

@Miguel Sanchez

2008 was known to be 2008 when Lehman Brothers failed – I remember that we were making forecasts at the time, and pretty much that week we had to throw out what we’d done and start fresh. However, I definitely accept your point – I have a strong prior bias towards the belief that monetary authorities will perform what appears to be optimal actions ex-post.

Even so, I can’t help but feel like a collapse in Europe just isn’t as serious as a collapse in the US – for NZ at least. I do think this is a big deal for Europe … but just not for the broader international economy.

I liked the RBA comments tbh:

http://www.bloomberg.com/apps/news?pid=20601087&sid=aU_IiA.bYUS0&pos=4

Note, even I wasn’t dismissive when Lehman collapsed:

http://www.tvhe.co.nz/2008/09/15/quick-links-for-lehman/

In fact, I think there were some important points regarding NZ there – I’d definitely look for the same channels now, which is why I’m not feeling the same degree of concern.

I don’t think we’ve reached the ‘Lehman point’ though – we’re more like in the six months between Bear Stearns and Lehman, the time when Lehman was gradually exhausting/ alienating its avenues for securing more funding.

@Miguel Sanchez

The policy errors occurred during Lehman’s though – the goal should have been to prevent a bank run at this point, and have an orderly unwind of bad assets.

The Bear Sterns to Lehman period was actually pretty good for global growth, even though credit markets were “dysfunctional” – that is why commodity prices shot off like no tomorrow. Lehman Bro’s changed the whole dynamic.

Are we looking at the same numbers? They shot off all right – downward, with the exception of oil.

@Miguel Sanchez

The period between Bear Sterns and Lehman brothers? In level terms, our TOT peaked in March 08, which was about Bear Sterns time. It remained elevated over the rest of the year – before prices collapsed at the end of the year. We were still getting historically nice prices for a significant period following Bear Sterns collapse.

we are looking at the same numbers as well…all down but not oil. interesting times.

@Matt Nolan

Prices for many of our commodity exports are agreed 6+ months before delivery. If you want to look at what commodity prices did over a 6-month period, the terms of trade is the worst measure you could come up with.

@Miguel Sanchez

Even taking that the TOT was at a historically high level 6 months after Bear Sterns right so …

Also, the TOT can be a sharper measure – when a whole lot of our trading partners suddenly have to slip out of the contracts as the price of their outputs has collapsed and they are otherwise going bankrupt. That was part of the reason we saw the TOT react more quickly through 2009.

I agree that Bear Sterns was a big step up from mid-2007, when TED spreads exploded for the first time. Things started to hit the fan in mid-2007, we reached a worse stage in Mar-08, and then dropped like a stone in Sep-08.

I don’t expect such a systematic failure on global credit markets this time. Now, even in this situation I can see it lowering commodity prices relative to the record highs they are at – but I don’t see it becoming a Lehman style issue.

To use your analogy, if we are at the Bear Sterns point, I have faith that the ECB will backstop the major European banks – a little bit of bankruptcy across southern Europe will hurt Europe, but it won’t lead to a comparable systematic banking crisis.

Note that one of the big kickers is transparency here – when Lehman collapsed no-one knew who had the debt, if southern Europe collapses people know who to shun – so it doesn’t have the same spillover on the rest of the credit market.

Matt, you’re talking about the terms of trade in theory. In practice – the way it’s actually calculated in this country – it has a massive lag. The fall in the TOT in 2009 was a catch-up to the fall in world prices in 2008.

I wouldn’t have any faith in the ECB – they have always been a house divided, and ultimately the German bloc would rather see the euro burn.

Nor would I have your faith that anyone “knows who has the debt”. In the lead-up to the euro, EVERY country engaged in the kind of financial shenanigans that Greece has been accused of. Heck, I have a colleague who did some of those deals.

@Miguel Sanchez

I do see what you are saying. And a lot of people seem to have little faith in the ECB – a lot of people calling them a “dinosaur”. Furthermore, it is true that the debt is not completely concentrated. However, A LOT of it is. I like this graph:

http://www.ritholtz.com/blog/2010/05/europes-web-of-debt/

In a week we will have a stronger idea of what is going on. I’m still backing the idea that the impact on NZ will be minimal. I hope not to be proved wrong, mainly because I’m sick of recessions 😉

I wouldn’t call the ECB a dinosaur – more of a Frankenstein’s monster.

Again, that “web of debt” is the stuff that people know about, not the off-balance sheet shenanigans that everyone took part in – including Germany and France.

I’m also hopeful that Europe will pull itself back from the brink – I’m just afraid they’ll have to send themselves all the way to the brink in the first place, before the authorities finally “get it”. In the meantime, I find your reassurances very un-reassuring – try replacing “Europe” with “housing”, and “southern Europe” with “subprime”, and see if it has a familiar ring to it.