My copy of Capital hasn’t arrived yet

So I can’t start reviewing it. I am very excited, as I’ve told readers before my first economics book (which I didn’t read particularly well) was Das Kapital, so my formative experience with economics was one about factors shares. To get myself ready I have been reading around the issue – on top of the usual reading I’ve been doing on income distribution work I’ve been trying to catch up a little bit on the factor share stuff. So I’m excited about my book finally turning up. One of the issues with living in New Zealand I guess!

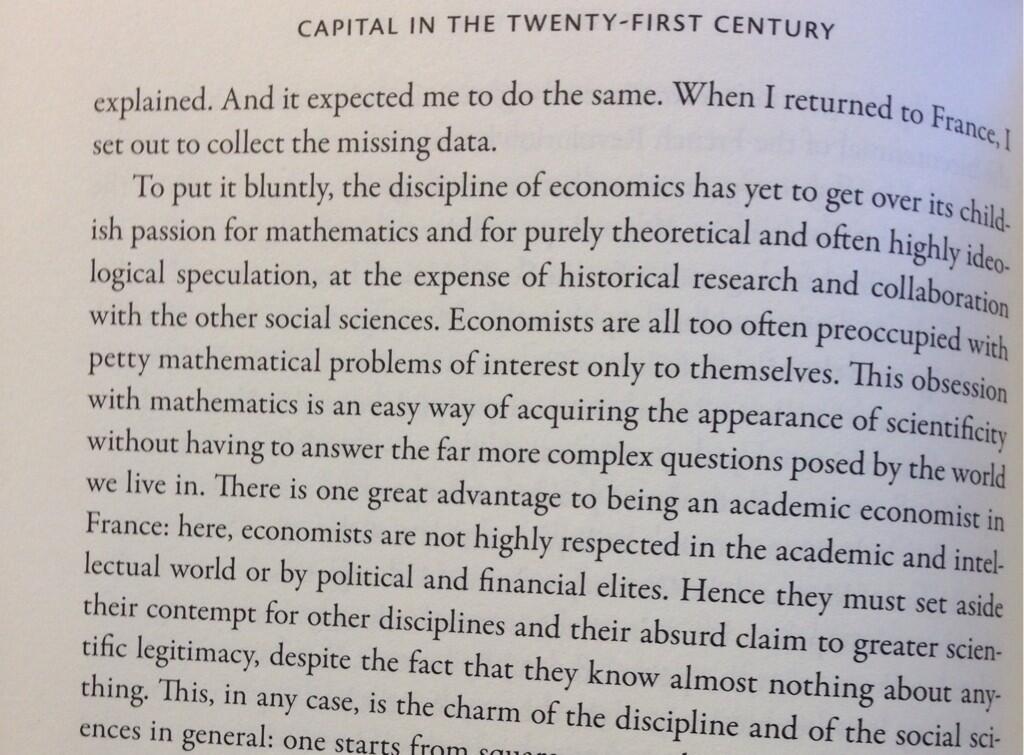

However, I’ve seen some people discussing it on twitter, and I was a bit upset about this part of the book:

As I said:

@RebelEconProf @withinepsilon @pdmsero Such an attack by P is simply a way to divert attention from the question of causation – disappointed

— TVHE (@TVHE) March 14, 2014

I hope this is not representative of what happens in the book. It betrays one of two things:

- a fundamental misunderstanding of what economic modelling is and why it is used as a tool

- a straw man attack (a particularly arrogant one) used to take away attention from any inadequacies in his own argument

Given Piketty is several orders of magnitude smarter than me, it has to be the second – which is a very disappointing rhetorical play to roll out when discussing economic issues 🙁

He is legitimizing a view of the discipline that is frankly false and not helpful for us trying to answer questions to create knowledge – economists have the role of discussing trade-offs to help us consider what is going on in the world around us, waving our disciplinary wang in each others faces to try to win an argument without proper discourse doesn’t help this!

French economists do have their blind spots.

Philippe Aghion is a great growth theorist, but I saw him mention taxes only once in a short footnote on Prescott. He is very good on the costs of employment protection laws to creative destruction.

On the rich, Thomas Piketty and Emmanuel Saez showed that the earnings and accumulated wealth at the top have dived with each recession. They showed that the people who really rake it in invest long hours in striving for high pay. They showed rather well that the working rich have replaced the rentier class of days gone by at the top of the income distribution.

Very good – I am looking forward to reading it, I was just a bit thrown by that statement. I struggle with polemics, and hope to one day avoid using them myself 🙂

I am looking forward to reading it, I was just a bit thrown by that

statement. I struggle with polemics, and hope to one day avoid using

them myself