How does uncertainty affect economy? What about monetary policy?

Why uncertainty matters?

The OECD has been warning everyone (Economic outlook 2019) , that the trade policy tension and uncertainty around it hit global economy hard. My question is, how can we think about uncertainty and its influence on monetary policy?

The idea of uncertainty about world trade influencing global growth is a hot issue. Uncertainty captures the idea of a spread of future outcomes, that a firm has some expectations over when making investment. Although there is a distinction between uncertainty and risk, the focus here is on investment given this spread. Namely, given some (irreversible) fixed cost of investing, the greater the uncertainty the more cautious firms get about investing.

As a way of understanding this in terms of trade risks, Ahir, Blolom and Furceri 2019 report that rising world trade uncertainty contributes significantly to rising overall uncertainty which ends up in output decline globally.

Thinking about this uncertainty about the future requires a link to economic activity. In this way, the focus is on how uncertainty affects the investment decisions of firms. For example, in this context Bloom et al 2019 found that uncertainty about Brexit referendum reduced investment by about 11% in the UK as well as productivity by 2-5%.

As we can see uncertainty shocks are very important and they have a significant detrimental effect on overall and individual economies around the world. But how can be conceptualise uncertainty shocks in terms of monetary policy?

The IS curve and an investment function

I’ve been told that the best way to work through ideas on a blog format is to think of the simplest types of examples possible, that show a behaviour – but still highlight key elements of the choices people make. For uncertainty, firm choice, and macroeconomic consequences I think the best idea is to think about a very simple investment function and how that relates across to overall expenditure in the economy through the IS curve

So let’s think about uncertainty in a “simplified macro model”, with an IS curve. The IS curve links interest rates to domestic demand – through an impact on consumption and investment.

If we think solely about the investment channel, then the relationship between output and the interest rate set by our central bank can be simplified even further – we can represent investment (where a level of investment will correspond to a level of output) by some “investment function” eg I = A – Br, where A is the amount of investment when the interest rate is zero and B is the amount investment falls as the interest rate rises. What does this look like:

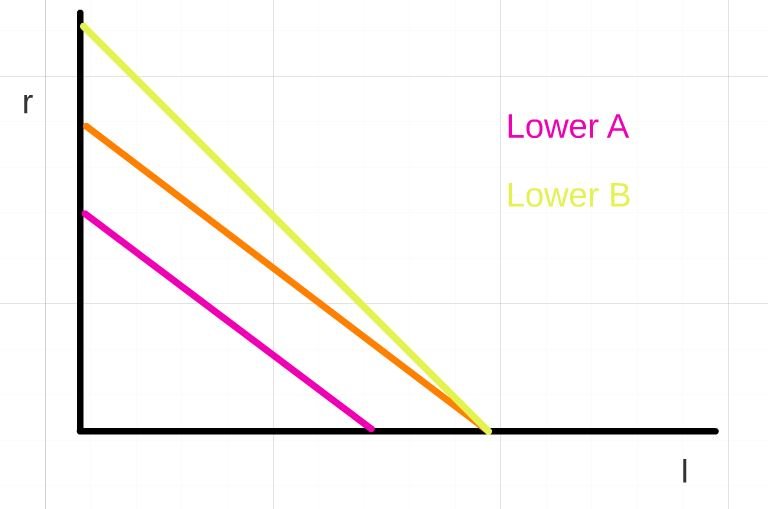

Now how does uncertainty influence this investment function? It can change the amount people want to invest irrespective of the interest rate due to higher risk (a decline in A) or it can change how responsive people are to interest rates when they make investment choices (a change in B), as a result this will change our investment function as follows.

Looking at the above it is clear that we need a reference – if uncertainty reduces the responsiveness to invest it must be from “some point”, in the curves above it was from an interest rate of zero. Instead we would normally think about this with respect to some level of output, which will refer to some level of investment – as follows:

So how can we use this to understand the choice of interest rates and monetary policy given uncertainty? I’ll give you my thoughts next week – but I’d love to hear your thoughts for now based on this framing down in the comments!