PSA: Just more misleading statistics

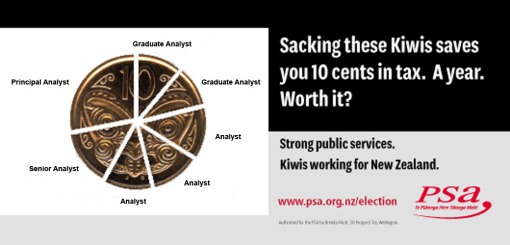

I was interested to see the Standard and No Right Turn link to a PSA advert from the latest Listener. The advert seems like a whole lot of mis-information piled right into a single page.

The criticism of the ad is quite simple – they come up with a sum and then they take away jobs people actually do care about in order to get to that sum, rather than actually describing the jobs that will be cut for any tax cut. Now I think people should know that a tax cut will lead to a cut in government spending – but telling them it will lead to less nurses is just wrong.

Furthermore, by illustrating the individual benefit but focusing on the full cost to society from the change, they exaggerate the size of the cost to the individual. If we have one less policy analyst what will that cost the individual compared to the 10c gain?

Ultimately, I agree that we as a society need to discuss the trade-off between the level of government spending and the size of tax cuts. However, the type of argument provided by the PSA ad (along with their constant stream of news releases) implies that spending by government is “virtuous” while the same spending by the individual is “waste” – I am not comfortable with this line of reasoning.

Anyway, given current policies and polling I suspect the trade-off will look more like this: