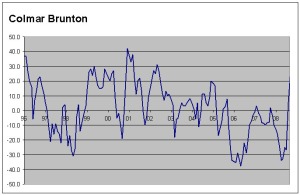

How much poorer is New Zealand than Australia?

Over at Anti-dismal, Paul Walker links to a paper by NZIER on New Zealand incomes relative to Australia.

In the paper, NZIER states that:

the average living standards of New Zealanders in 2007 were 24% lower than those of Australians (or equivalently, relative to living standards in New Zealand, Australia’s were

32% higher)

However, I am not convinced – not yet anyway. Here’s why: